The majority of consumers put off purchasing life insurance because they believe the cost would be too high, but protecting your loved ones doesn’t have to break the bank. Life insurance rates have been dropping in the United States for the last decade. Two-thirds of consumers overestimate how much life insurance would cost, usually by hundreds of dollars.

With 64% of Americans citing budget as the reason they don’t have coverage, we thought it was time to change that mindset. Life insurance can be as cheap as that cup of latte that we splurge on daily.

Term life insurance is the cheapest and most simple forms of life insurance. You choose your death benefit, the period of time you want the coverage for, usually 10-30 years, and the company charges a premium based on certain criteria. These factors include:

- Age

- Health Status

- Job

- Tobacco History & Use

- Hobbies

- Family History

- Financial History

As long as you pay the premium assigned by the company, you will have the coverage. Term life insurance does not build up any cash value and is used to cover items such as:

- Income Replacement

- Mortgage Loan

- College Tuition

- Funeral Expenses

- Business Loans

In this article we will be looking at sample term life insurance rates for different age brackets from some of the top life insurance companies in America. It’s important to always compare quotes with multiple carriers to ensure you find the best policy and best price. If you need an instant quote, please click on the link below.

INSTANT LIFE INSURANCE QUOTES

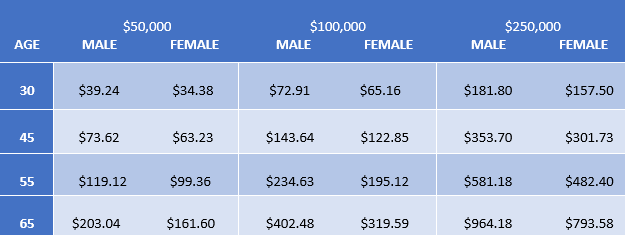

Term Life Insurance Rates from Top Life Carriers

Here are some sample term life insurance rates for men and women at different ages.

NOTE: All of these charts are based on monthly premiums

30-Year-Old Male-20 Year Term Life Insurance Rates-Preferred Nonsmoker

30-Year-Old Female-20 Year Term Life Insurance Rates-Preferred Nonsmoker

![]()

40-Year-Old Male-20 Year Term Life Insurance Rates-Preferred Nonsmoker

![]()

40-Year-Old Female-20 Year Term Life Insurance Rates-Preferred Nonsmoker

![]()

50-Year-Old Male-20 Year Term Life Insurance Rates-Preferred Nonsmoker

![]()

50-Year-Old Female-20 Year Term Life Insurance Rates-Preferred Nonsmoker

![]()

65-Year-Old Male-20 Year Term Life Insurance Rates-Preferred Nonsmoker

![]()

65-Year-Old Female-20 Year Term Life Insurance Rates-Preferred Nonsmoker

![]()

What is Whole Life Insurance?

Whole life insurance is a permanent life insurance policy with a guaranteed premium, guaranteed death benefit, and guaranteed cash value accumulation. Whole life covers the insured for their lifetime as long as premiums are paid in.

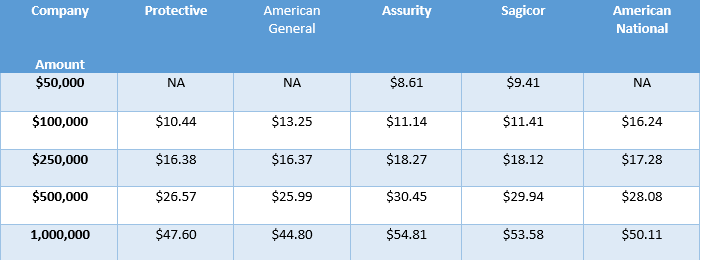

The one negative to whole life is the cost, especially if you purchase at an older age. We have compiled some whole life quotes for you to look at.

Whole Life Insurance Rates

Preferred Non Tobacco- Monthly Rates

What is Universal Life Insurance?

Universal life insurance, also called adjustable life insurance, is often compared to term life and whole life insurance hybrid. Universal life is a permanent life policy that builds up cash value, while lasting for the life of the insured.

Universal Life Insurance has 3 main policies to choose from:

- Guaranteed Universal Life

- Indexed Universal Life

- Variable Universal Life

It’s important to remember when it comes to universal life insurance that the premium is not always guaranteed. If the policy that you are looking is anything other than a guaranteed universal life, then your premium is most likely not guaranteed.

Premiums remaining level in an indexed universal life and variable life are tied to how the cash value performs inside the policy you purchased. If the cash value element performs as your agent illustrated you should have no problems, but if it doesn’t then your premiums could rise as you get older.

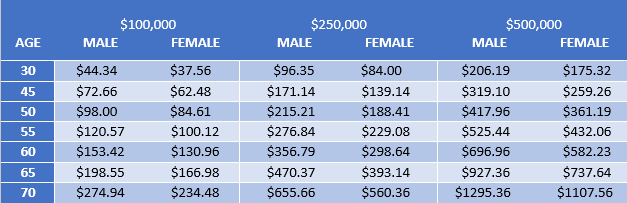

Guaranteed Universal Life Insurance Rates

Preferred Non Tobacco- Monthly Rates

We have decided to leave out sample premium rates for indexed and variable universal life. The reason for this is that the premiums paid into these policies can widely vary depending on what goals you are looking to achieve. It’s important to sit down with an experienced life insurance agent to go over all the particulars when it comes to a indexed or variable universal life policy.

Our Thoughts

So there you have it!! Sample monthly rates for term, whole, and universal life insurance policies. As you can see, term will always be you less expensive choice compared to whole and universal life insurance. With that said, it is important to work with a professional to make sure you choose which policy best fits your financial needs. If you have any questions or a comment, please don’t hestitate to give us a call.