Accidental Death and Dismemberment Insurance

Accidental death and dismemberment insurance (AD&D) is a type of insurance policy that pays if you die or are seriously injured accidentally, such as in an automobile accident.

Accidental death & dismemberment insurance is similar to regular life insurance in that both offer at tax free death benefit, but a AD&D policy doesn’t cover death caused by an illness.

Injuries covered under these types of policies are usually limited to cases in which you were to lose your sight, loss of speech or hearing, lose a limb or finger, or suffer paralysis as a result of an accident.

AD&D insurance is supplemental to your current life and disability insurance, not a replacement. Knowing the differences between AD&D insurance and traditional life insurance is important because this will probably be part of any benefits package offered by your employer.

You can purchase AD&D insurance as a standalone policy or some life insurance companies allow you to add an AD&D rider to your traditional life insurance. You also probably receive offers through your bank or credit union.

If your family depends on you financially and would be in tough spot if you died, buy life insurance, not Accidental death and dismemberment insurance.

Use individual disability insurance to cover the risk of being unable to work due to an illness or injury. The most important thing to remember is that AD&D is a supplement to your life and disability insurance.

How Does Accidental Death and Dismemberment Insurance Function?

Let’s say you purchase a $250,000 AD&D insurance policy. This policy will not cover that amount or pay a claim for all situations. Most AD&D insurance policies function like this.

- If you die from an accident, then 100% or $250,000 is paid to your beneficiary tax-free.

- These policies usually pay a percentage of the face amount for an injury caused by an accident. To give you an example:

- You might collect 25% if you were to lose a finger or two

- 50% of face amount if you lose a hand or foot

- 100% of face amount if you lose 2 or more limbs or sight in both eyes

- If death is by an illness, then nothing is paid out

Check out the chart below to see how some policies would pay for dismemberment:

![]()

Scenario’s where AD&D Insurance will not pay

NOTE: It’s very important to read and understand what your accidental death and dismemberment insurance covers and does not covers. This will alleviate any misunderstandings.

In order for an AD&D insurance to pay out, death or injury must be a result of an accident and not caused by any pre-existing conditions. To give an example, if you are driving and suffer a stroke, which causes a deadly car crash, the insurance company will likely not pay the claim.

Also, even if involved in an accident that ultimately ends in death, there are time frames that death must occur before a claim is paid. Some insurance companies are few months up to a year. It’s important to know what your policy offers.

Accidental Death and Dismemberment policies also exclude the following:

- Driving while drunk

- Skydiving

- Suicide

- Racing Cars

- War

- Bungee Jumping

- Hang Gliding

- Drug Overdose

- Surgery

Why is AD&D Insurance So Cheap?

AD&D Insurance is so inexpensive because it’s such a low risk to life insurance companies. You have a 1 in 112 chance of dying in a car accident. Compare this to a 1 in 7 chance of dying from heart disease or cancer. See the difference.

Accidental deaths in 2016 only accounted for 5.4% of deaths in America, but between the ages of 25 to 44 they made up 30.2% of deaths. This is why we recommend AD&D insurance on our younger clientele and not so much on clients getting close to retirement.

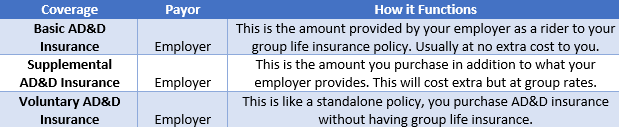

Types of AD&D Insurance offered by your Employer

If your employer offers group life insurance, then accidental death and dismemberment insurance is usually provided with your policy. AD&D policies offered by your employer are referred to as:

Top 10 Companies Selling AD&D Insurance

Below is list of who we think have the best accidental death and dismemberment insurance policies:

- Assurity Life

- Prudential

- Aflac

- Transamerica

- Fidelity Life

- AIG Direct

- Sun Life Financial

- MetLife

- MassMutual

- Mutual of Omaha

Final Thoughts

Accidental death and dismemberment insurance can be an inexpensive supplemental life policy to own when your are young. With that said it is just that, supplemental. Always read the benefits sections of any policy that you are considering.

Many companies have different situations they cover so it’s important to understand your policy. Always work with an independent agent who can give you quotes from multiple carriers. If you have any questions or comments please don’t hesitate to give a shout.