Prudential Life Insurance Review

With the explosion of the internet, it seems like their are a lot of life insurance companies to choose from. Choosing the best life insurance company can be the difference in savings of hundreds of dollars a year if not more.

One company that should always be considered when looking into life insurance is Prudential Life Insurance. Prudential Life is also referred to as Pruco Life Insurance.

The History of Prudential Life

Prudential Life has over 140 years of experience selling insurance products and offering financial services. They help individual as well the institutional customer with growing while protecting their wealth.

Pruco Life Insurance has become one of the most recognized life insurance companies in the United States, as well as around the world. Today, Prudential Life Insurance has operations in Asia, Europe, and Latin America.

Prudential offers many different products and services, such as:

- Life Insurance

- Annuities

- Mutual Funds

- Investment Management

- 401-K Administration

Prudential Life Insurance is headquartered in Newark, NJ and continues to it commitment to its mission of creating long-term value for its stakeholders through strong business practices.

Prudential Life Insurance Financial Ratings

Prudential Life had over $1.366 trillion in total assets alongside $3.7 trillion of life insurance on the books. Pruco Life Insurance boasts strong ratings from all the insurance company rating agencies.

- Fitch Ratings: AA-

- Standard and Poor: AA-

- A.M. Best: A+

- Moodys: A1

Although financially, Prudential is strong, but they received a grade of B from the Better Business Bureau.

Who is Prudential Life Best For?

- If you occasional smoke cigars or chew, Pruco Life offers non-tobacco rates instead of tobacco.

- Prudential life insurance has a favorable rating system for consumers with high cholesterol levels of 7.0 and below.

- Controlled type 2 diabetes can qualify for a standard rate with Prudential Life Insurance.

Products offered by Pruco Life Insurance

Prudential Life Insurance offers term life, permanent life, and other types of life insurance products.

Prudential Term Life Insurance Products

Prudential Life offers 6 term life insurance products. These products are designed to meet different financial objectives. All of Prudential Life term products include

- Premiums are guaranteed

- Terminal Illness Rider

- Tax-Free Death Benefit

MyTerm

This term policy offered by Pruco Life is no exam life insurance with coverage up to $250,000 and term lengths of 10, 15, 20, and 30 years depending on age.

MyTerm is not a convertible policy which means you cannot convert to a permanent policy later down the road, like you can with most term policies.

Term Essential

Term Essential is an alternative to MyTerm. Term Essential offers you the ability to customize your life insurance with riders that is not offered by MyTerm.

Term Elite

Term Elite has the same features as Term Essential except you are allowed to convert your policy to something permanent without having to go through a medical exam.

If you convert your policy within the first 5 years of your plan, you can get credit for your first year premium on the permanent policy.

PruLife Return of Premium

Prudential Life offers a return of premium term life insurance policy for term periods of 10-30 years. At the end of the term period if you are still alive and policy is inforce, you receive all premiums that were paid in back.

Pru WorkLife 65

The WorkLife 65 term policy offered by Prudential Life Insurance was designed for consumers during their working years. Premiums remain level to age 65, then begin to increase each year till age 85.

If you become disabled or unemployed, Pru WorkLife 65 will wave all premiums. Note that the policy has to have been inforce for 12 months for this feature to kick in.

PruTerm One

If you are in need of short-term coverage, then the PruTerm One is the product for you. The PruTerm One is an annually renewable term. This is ideal for consumers who are paying off short loans, or those in between jobs but in need of life insurance still.

Prudential Life Insurance Sample Term Rates

30 Year Old Female- Preferred Plus Rates

50 Year Old Male- Preferred Plus Rates

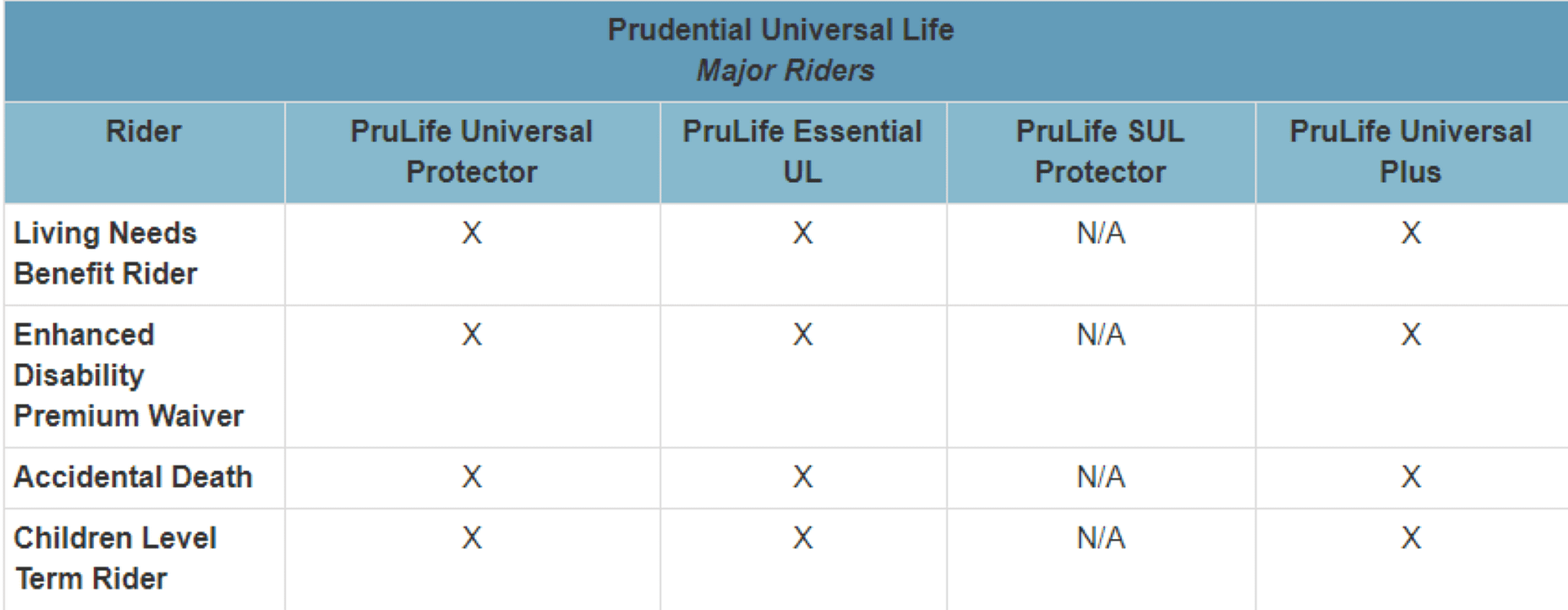

Universal Life Insurance offered by Prudential

Pruco Life Insurance offers 4 universal life products with many riders for you to enhance.

PruLife Universal Protector

This is Pruco Life Insurance core universal life insurance product. PruLife Universal Protector comes with an adjustable death benefit and a guaranteed premium to age 120.

You can also customize how long you have coverage for, such as to age 90 or 95, which will lower the cost of premiums.

PruLife Essential UL

This universal life product offered by Pruco Life offers many of the same features as the PruLife Universal Protector. The main difference is with the PruLife Essential UL you have access to a portion of the death benefit if you become chronically ill.

PruLife Essential UL also offers a no-lapse rider which allows you to continue coverage if you take a loan out.

PruLife SUL Protector

The PruLife SUL Protector is a second-to-die policy. This means that 2 lives are covered under this policy with the claim being paid on the second persons death.

These polices are great for consumers who have estate problems or looking to fund a trust after their deaths.

PruLife Universal Plus

If you are looking for a life insurance policy with potentially higher cash value growth, then the PruLife Universal Plus might be the product for you.

The rate of returns are variable, but Prudential Life does offer a minimum guaranteed interest rate. The cash value can be accessed via loans or withdrawals throughout the life of the contract.

It’s important to note that the premiums are not guaranteed and sometimes rely on the cash value to perform in order for premiums to remain level.

Indexed Universal Life offered by Pruco Life

An indexed universal life product is designed for cash accumulation. They grow at a fixed rate or tied to stock indexes, such as the S&P 500 or Nasdaq. Indexed UL come with a floor, usually 0%, and caps your earnings.

Pruco Life Insurance offers 3 indexed universal life products.

PruLife Founders Plus IUL

PruLife Founders Plus IUL is the core IUL policy offered by Pruco Life Insurance. You have an option of a fixed rate or an indexed rate. It also comes with a no lapse guarantee rider, which keeps premiums level. Index options are limited with this product.

PruLife Index Advantage IUL

This product has the most potential in terms of cash value accumulation. The PruLife Index Advantage offer 4 interest crediting options. You can protect your death benefit with the 20 year no lapse rider for an additional fee.

PruLife Survivorship IUL

The is a second-to-die or survivorship product offered by Prudential Life Insurance. It comes with a no lapse premium rider, adjustable death benefits, and cash accumulation. They are great for charitable givings or estate planning.

Variable Life Insurance offered by Prudential

Variable life insurance is probably the riskiest life insurance product on the market as well as the hardest to understand. We highly recommend working with a highly experienced agent before purchasing a variable life product.

Prudential offer 3 different variable life insurance plans.

- VUL Protector

- PruLife Custom Premier II

- PruLife Survivor VUL Protector

Our Thoughts

First off it’s important to understand that life insurance companies differ, whether its with the cost of the insurance, their financial ratings, or how they underwrite certain health conditions, so it’s always best to shop around.

With that said, Prudential Life Insurance company is great company to start with. They have some of the strongest ratings and competitive rates of any company out there.

We hope this article helps with your hunt for a great life insurance company. Here at EasyQuotes4You we can help you navigate which company best fits your situation.

If you have any questions or would like some quotes, please leave us a comment or give us a call.

How long has Prudential been in business?

Prudential Life has over a 140 years of experience selling insurance products and offering financial services. They help individual as well the institutional customer with growing while protecting their wealth.

Is Prudential Life a strong insurance company?

Prudential Life had over $1.366 trillion in total assets alongside $3.7 trillion of life insurance on the books. Pruco Life Insurance boasts strong ratings from all the insurance company rating agencies.

Fitch Ratings: AA-

Standard and Poor: AA-

A.M. Best: A+

Moodys: A1

What types of term life does Prudential offer?

Prudential life offers level term life with coverage periods of 10, 15, 20, and 30 years. They also offer Return of Premium Term life, which returns all premium at the end of the coverage period.