Typically, most people don’t wake up in the morning thinking today is the day I’m buying life insurance. In most cases, people are motivated to buy life insurance because of a live event, usually a birth or a DEATH. Sometimes its effective advertisement or maybe even a pesky relative who’s just gotten in the business and calls you every day until you agree to talk about it. Either way, it is a crucial part of future planning.

Just like preventive medical procedures, you shouldn’t wait to address your need for life insurance until you start feeling the symptoms of a problem. Life events happen and most of the time it’s unexpected.

Like a close friend that suddenly dies of a heart attack or perhaps your favorite aunt calls to let you know Uncle Joe died with no life insurance. Her next statement is asking “how do I start a Go Fund Me page for his funeral?” Like I said, it’s usually about life events.

Life insurance is complicated and confusing unless you’re in the business. There are hundreds of companies to choose from and each of them has dozens of products, so how do you know which life insurance plan is right for you?

Honestly, it’s not that difficult if you start with the basics, term insurance or permanent insurance. And, to make it even more simple for you, we’ll discuss whole life vs. term insurance – which one should you choose?

What is Whole Life Insurance?

Whole Life insurance has been around longer than term insurance and universal life insurance. It is considered permanent life insurance because the policy will stay in force over a lifetime as long as the premium is paid.

Whole life is a little more complicated than term insurance. It has a cash value component which is like an investment account that is coupled with your life insurance coverage. This cash account accumulates money over time and earns a minimum interest rate that is specified by the company.

Basically, the cash account is created because a portion of your periodic premium payment (not used to pay for life insurance) is deposited in the cash account and earns interest which is tax-deferred. Additional funds can result from dividends that are paid by the insurance company (for participating policies) and they too, can earn interest as well.

This cash account can be accessed for any reason by the policyholder through policy loans, withdrawals, or by surrendering the policy. There are no qualifications to get this money except there must be money available. In fact, you don’t even have to pay back the loan.

And, since the loan doesn’t reduce your cash value (the account is collateralized for the loan – not reduced) you’ll continue to earn interest even while the loan is outstanding.

If you decide not to repay a loan, the outstanding balance will simply be deducted from the death benefit when a claim is filed.

Sample Whole Life Insurance Rates

![]()

What are the Pros and Cons of Whole Life Insurance?

Pros

- Whole life insurance provides coverage for a lifetime and cannot be canceled by the company for any reason other than non-payment.

- Whole life insurance has level premiums for the life of the insured. This means the insurer cannot raise your premiums for any reason.

- Whole life insurance builds cash value that earns interest over time. The cash can be accessed by the policy owner in multiple ways.

Cons

- On average, whole life insurance can cost about 6 to 10 times more than term insurance

- The interest you’ll earn in your cash account is typically less than what you’d earn in traditional investment products.

- Whole life can be a complicated insurance product and is not a good candidate for direct purchase from an insurance company.

What is Term Life Insurance?

Term life insurance is “pure” life insurance and does not have cash value like whole life. It is a very straightforward type of insurance that has a limited policy period (term) which the applicant selects at the time of application. Most companies offer 10, 15, 20, 25, and 30-year policy terms and in most cases, the premium remains level for the term that’s been selected.

Since term insurance is considered “temporary” coverage, the premiums are much less than whole life insurance. If the insured dies during the policy period, the beneficiary will receive the death benefit, if they die outside the term of the policy or outlive the policy, no death benefit is available.

Although term is considered “pure” insurance with only a death benefit, there’s other options (riders) that can be added to the policy to broaden the coverage and provide some living benefits. The most popular (and important) rider is the conversion privilege.

The conversion privilege rider in a term policy provides the ability to the policyholder of converting their term policy to a permanent policy before the end of the policy period.

The most important feature in the conversion privilege is that the insured does not have to prove insurability. This means that your new rate will not be impacted by any health issues you have developed since the term policy was issued.

Sample Term Life Insurance Rates:

Female/ Age 40/ 20 Year Term/ Non-Tobacco

![]()

Male/ Age 40/ 20 Year Term/ Non-Tobacco

![]()

What are the Pros and Cons of Term Life Insurance?

Pros

- Term life policies are straightforward and easy to understand

- Term life insurance is the most affordable life insurance in the marketplace

- Companies that offer term life insurance generally provide several riders that can be added to the policy.

- The insurance premium will remain level during the “guarantee period” which is usually the term of the policy.

Cons

- If your policy expires and you haven’t converted it or paid the renewal premium, you have no more coverage.

- Term life insurance does not build cash value.

- Once your term policy is issued it cannot be changed for any reason, unlike Universal life insurance which allows the policyholder to manipulate the premium payments and death benefit.

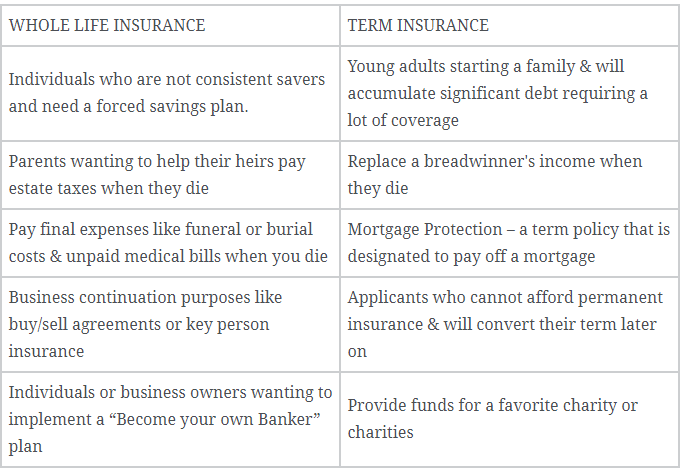

Which Policy should People Choose – Whole Life or Term Insurance?

The type of insurance policy you choose to purchase should be based on your individual needs and your budget. Below, we have listed the most common reasons for choosing between whole life and term insurance.

Whole Life vs. Term Insurance – The Bottom Line

The most efficient way of deciding which type of insurance policy will work best for you is to contact an independent insurance professional. Unlike a company agent (captured agent), an independent insurance agent typically represents many of the top-rated insurance companies who offer various life insurance products.

As an independent business owner, an independent agent will always put the needs of their clients and prospective clients first and foremost while having access to the best and most competitive products and prices. If you have any questions or comments please don’t hesitate to give us a call.

Frequently Asked Questions

What is term life insurance?

Term life insurance is “pure” life insurance and does not have cash value like whole life. It is a very straightforward type of insurance that has a limited policy period (term) which the applicant selects at the time of application. Most companies offer 10, 15, 20, 25, and 30-year policy terms and in most cases, the premium remains level for the term that’s been selected.

What are the pros' of term life insurance?

The pros’ of term life insurance are:

1. Term life policies are straightforward and easy to understand

2. Term life insurance is the most affordable life insurance in the marketplace

3. Companies that offer term life insurance generally provide several riders that can be added to the policy.

4. The insurance premium will remain level during the “guarantee period” which is usually the term of the policy.

What are the cons' of term life insurance?

The cons’ of term life insurance are:

1. If your policy expires and you haven’t converted it or paid the renewal premium, you have no more coverage.

2. Term life insurance does not build cash value.

3. Once your term policy is issued it cannot be changed for any reason, unlike Universal life insurance which allows the policyholder to manipulate the premium payments and death benefit.

What are the pros' of whole life insurance?

The pros’ of whole life insurance are:

1. Whole life insurance provides coverage for a lifetime and cannot be canceled by the company for any reason other than non-payment.

2. Whole life insurance has level premiums for the life of the insured. This means the insurer cannot raise your premiums for any reason.

3. Whole life insurance builds cash value that earns interest over time. The cash can be accessed by the policy owner in multiple ways.

What are the cons' of whole life insurance?

The cons’ of whole life insurance are:

1. On average, whole life insurance can cost about 6 to 10 times more than term insurance

2. The interest you’ll earn in your cash account is typically less than what you’d earn in traditional investment products.

3. Whole life can be a complicated insurance product and is not a good candidate for direct purchase from an insurance company.