What is Life Insurance Used For?

Let’s face it; basically, every one of us has heard about insurance and its many types — car insurance, life insurance, health insurance, homeowners insurance, travel insurance and more.

But of course, our focus here is on life insurance. In today’s world, insurance and its processes can seem a bit confusing and difficult to understand. In essence, some people may actually find it hard to get a grasp on what they really want or need. This is especially true for life insurance.

You should understand that life insurance is very important for just about every household out there. And as you probably guessed, it’s meant for those who have loved ones that depend on them, especially financially.

The key point here is that life insurance covers the financial needs of your dependents (family) in the event of your death. With this in mind, one can easily tell that life insurance is not an option but a necessity for those who know the importance of having a sound financial plan for now and the future.

Moving forward, the good news is, you don’t really have to spend a fortune to get coverage. Yes, depending on the policy you choose, life insurance is cheap and affordable. You only must take your time to do your research and of course, stick to the coverage that’s sure to work great for you and your loved ones.

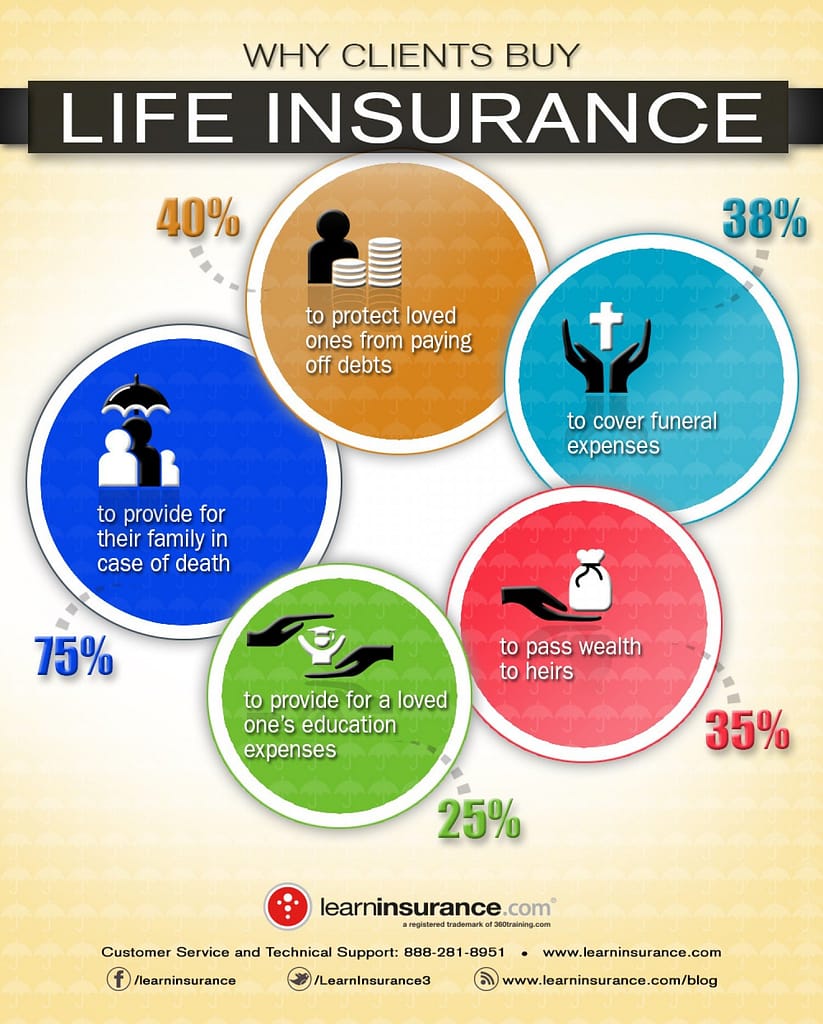

Still contemplating getting life insurance today? If yes, here are a few reasons why you should take the plunge right now.

What is Life Insurance For?

Check out the 6 reasons to have life insurance and what it can be used for.

As mentioned earlier, it’s incredibly important for the benefactor of every family to buy life insurance as soon as possible. Yes, with the right type of life insurance, you can be sure of protecting your family and meeting their financial needs if you pass away.

For the most part, life insurance makes it possible for your partner and kids to sustain their standard of living should you die unexpectedly. That said, it’s basically your responsibility to quit procrastinating and of course, plan towards getting adequate coverage.

Of course, you wouldn’t want your loved ones to look helpless when bills begin to add up following your death, right? Just get life insurance today and you’re good to secure their future!

Here’s the thing; a person’s death doesn’t wipe off debt — in fact, that’s the time when things get more complicated.

For instance, should you pass away, your spouse could end up bearing the burden of outstanding debts like mortgage, car loans and more.

And unfortunately, these (coupled with other expenses) can quickly add up and leave your family with extra financial burden. But of course, the good news is, you can be in control of the situation if you can just make the decision to buy life insurance today.

So yes, your family (spouse, parents, and kids) will only have to accept whatever life brings them and of course, worry less about debts and other lingering expenses.

Do you know that you can create an inheritance for your kids when you buy an insurance policy?

Well, if you didn’t, now you do! With the right insurance policy, you can leave a legacy for your children even if you don’t have any other assets to pass to them. Life insurance can also be used to fund a special needs trust.

The tax free lump sum will come in handy when your family needs money to take care of a thing or two in the future, and if your children are matured enough, they can invest the payout, so it has the potential to grow in value. Life Insurance comes tax free to your beneficiaries!!

Ever given thought to how your spouse and kids will feel when you’re gone? Well, there’s no doubt that they’re going to feel bad, but of course, you can still do a few things to ensure that they get the best out of life even in your absence.

When you purchase the right life insurance policy, you’ll get to rest easy knowing that your kids and loved ones will be well taken care of when you’re no longer with them.

For instance, with better financial security, your children will get to enroll in college, get the best education and even better, take care of other life necessities like getting married or kick-starting a business. In a nutshell; it’s crucial to get additional coverage while your children are still with you — their financial future is in your hands.

At this point, you should be aware that there are many types of life insurance. They are Term Life Insurance, Whole Life Insurance, & Universal Life Insurance.

Term Life Insurance covers you for a specific period of time and builds no cash value.

Whole Life and Universal Life Insurance are permanent life products that can build a cash value over time. The good thing is you can borrow from these policies any time in the form of tax-free loans.

I have seen cash value used to buy a car, a down payment on a new house, and even to pay for college. If funded properly these types of policies can even add supplemental retirement income.

You love your family and of course, wish you could live with them forever — there’s no doubt that. But hey, we’re all going to pass on someday and we don’t get to know when that is.

Yes, it could be today or even 60 years from now; it’s just going to happen. That said, it’s certainly in your best interest to do what you can to protect your beautiful family from the uncertainties of life.

Getting life insurance is one of the few things you can do to bring you and your family peace of mind. With this additional coverage, you can be sure that your family will do just fine (financially) in the event of your passing.

Of course, no amount of money can fill the void of the loneliness that comes with losing a loved one, but trust us, having the assurance of financial security will certainly go a long way in making life comfortable in the long-run.

And there you have it! These are the 6 good reasons why you can’t afford to wait any longer. Now is the right time to buy life insurance — remember, the longer you wait, the higher the chances of something happening before getting covered. Don’t hesitate to reach out for an instant quote today!

What is life insurance used for?

Life insurance is used to pay off debts or a mortgage, to replace income, pay for burial expenses, and business loans to name a few. Life insurance is used to protect a loved ones or a business financially.

Can I buy life insurance to pay off my mortgage if I die?

You can buy a term life insurance policy for 15 or 30 years to cover your mortgage. Choose the amount of years to carry the term insurance to correlate with the number of years you have left on your mortgage.

What do business' use life insurance for?

A business will use life insurance if it has outstanding loans or debt. Life insurance is also used in buy/sell agreements and key man insurance.

Should I own life insurance if I am the sole income provider?

Yes. Yes. Yes. If you are the sole income provider for your family you should own at least 8-10X your salary to ensure your loved ones are protected if you were to die.