Mutual of Omaha Life Insurance Review

In this article we will dive into Mutual of Omaha’s life insurance products, financial strength, and their niche coverage’s. Mutual of Omaha Life Insurance has been offering insurance products for over 100 years and prides itself on excellent customer service and innovative products.

With more than $30 billion in assets under their management, Mutual of Omaha is one of the top insurance companies in the industry today.

Mutual of Omaha (MOO)Life Insurance Ratings

Mutual of Omaha Life Insurance is considered an extremely strong financial company. They have earned the top ratings from all the insurance rating agencies. Strong financial ratings ensure that policyholders can know their claims will be paid when the time comes.

Mutual of Omaha (MOO) Ratings Summary:

MOO also has a Comdex ranking of 93 (out of 100) which makes them one of the highest rated life insurance companies in America.

Mutual of Omaha (MOO) Life Insurance Products

Mutual of Omaha Life Insurance offers fully underwritten life insurance policies as well as simplified issue or no exam life insurance policies. MOO offers term life, guaranteed universal life, whole life, indexed universal life, disability, long-term care and accidental death insurance. It’s important to understand what each product offers to ensure you choose what best fits your needs and financial objectives.

Mutual of Omaha (MOO) Term Life Insurance Policies

Mutual of Omaha Life Insurance offers the several type of fully underwritten term and permanent life insurance policies. When choosing one it’s important to review all your options and not make your choice based solely on price. This would be doing a disservice to your loved ones.

Term Life Answers (TLA)

This product is a level term life policy with coverage options for 10, 15, 20, and 30 years. This is Mutual of Omaha fully underwritten term life policy.

Face Amounts range from $100,000 to $2,000,000 of coverage. Any amount over $2,000,000 requires home office approval.

Issue ages are as follows:

- TLA 10 Years

- Non-tobacco: 18-80

- Tobacco: 18-75

- TLA 15 Years

- Non-tobacco: 18-74

- Tobacco: 18-70

- TLA 20 Years

- Non-tobacco: 18-68

- Tobacco: 18-65

- TLA 30 Years

- Non-tobacco: 18-55

- Tobacco: 18-50

Term Life Answers Optional Riders

- Accelerated Death Benefit for Terminal Illness Rider

- Accidental Death Benefit Rider

- Waiver of Premium for Unemployment Rider

- Dependent Children’s Rider

- Other Insured Rider

- Disability Waiver of Premium Rider

Mutual of Omaha Life Insurance term life policy is fully convertible to age 75, but a 30 year term is only convertible the first 20 years.

Term Life Answers Sample Rates

Preferred Non-Tobacco/ Monthly Rates/ 20 Year Term

![]()

Term Life Express (TLE)

Term Life Express (TLE) is MOO’s simplified issue or no exam term life insurance product. TLE offers a simple underwriting process, which allows clients to skip the exam and get their policies issued faster.

Term Life Express offers coverage from $25,000 to $300,000 of death protection without an exam if you are between the ages of 18-50.

If you are between the ages of 51-65, TLE offers coverage from $25,000 to $250,000 without an exam.

Issue ages for TLE are as follows:

- TLE 10 & 15 Years

- 18-70

- TLE 20 Years

- 18-60

- TLE 30 Years

- 18-50

Term Life Express Optional Riders

- Accelerated Death Benefit Riders

- Residential Damage Waiver of Premium Rider

- Waiver of Premium for Unemployment Provision

- Common Carrier Death Benefit Provision

- Accidental Death Benefit Rider

- Dependent Children’s Rider

- Disability Income Rider

- Disability Waiver of Premium Rider

- Return of Premium Rider

TLE is fully convertible to age 70, but only to one of their simplified issue products.

Term Life Express Sample Rates

Standard Non-Tobacco/ Monthly Rates/ 20 Year Term

![]()

Mutual of Omaha Permanent Policies

Mutual of Omaha Life Insurance has very extensive lineup of permanent life insurance products. They offer guaranteed universal life, traditional universal life, indexed universal life, whole life, and accidental death insurance.

All come with different “bells and whistles” so it’s important to fully understand each product.

Mutual of Omaha Whole Life Insurance

Living Promise Whole Life:

MOO’s Living Promise Whole life policy offers a simplified underwriting process with level and graded death benefit options to seniors across the United States.

Living Promise Product Specifications:

![]()

NOTE: The graded death benefit plan pays a limited benefit the first 2 years of the contract. This means, a claim is only paid for accidental death the first 2 years of the policy.

Sample Rates for Living Promise Whole Life (Level Death Benefit)

Standard Non-Tobacco-Monthly Rates

Children’s Whole Life

MOO’s Children’s Whole Life is permanent life insurance, usually purchased by parents for their children. Each policy comes with a guaranteed insurability rider which locks in your child’s health regardless of how it changes in the future.

Issue Ages: 14 Days-17

Face Amounts: $5,000-$50,000

Optional Riders Available:

- Guaranteed Insurability Rider

- Death of Policy Owner Waiver of Premium Rider

Sample Rates for Children’s Whole Life

![]()

Mutual of Omaha Guaranteed Universal Life (GUL)

Mutual of Omaha Life Insurance offers a fully underwritten GUL and a simplified underwriting (no exam required) GUL product, referred to as GUL Express. Both come with a guaranteed premium and death benefit to age 120, while building up cash value overtime.

Mutual of Omaha Guaranteed Universal Life Specs:

![]()

Traditional Universal Life offered by MOO

Mutual of Omaha Life Insurance (MOO) offers 2 adjustable life insurance products that are used to build strong cash value that is safe from the risk of market fluctuations.

The cash value can be used later to help fund college education or supplement your retirement. Premiums are adjustable and death benefits are flexible.

Mutual of Omaha Universal Life Insurance Specs:

![]()

These policies come with a no-lapse guarantee for a certain number of years. They are based on the amount of premium chosen to pay and your age. Look below:

![]()

Mutual of Omaha Indexed Universal Life Insurance

MOO’s indexed universal life is a permanent product designed to emphasize strong cash value accumulation. Interest is based on market index performance, which gives the consumer potential for greater growth than with the traditional universal life policy with a fixed interest rate.

These policies are used when consumers are looking for aggressive growth of their cash value, without the risks involved in investing directly into the market.

Mutual of Omaha Accidental Death Insurance

MOO’s Accidental Death Insurance is a guaranteed issue life insurance policy, that only covers accidental deaths. This premiums are guaranteed renewable to age 80, with face amounts ranging from $50,000 up to $500,000. These policies are excellent for consumers who can’t afford or can’t qualify for term life insurance.

The only optional rider for this policy is the Return of Premium rider. This rider allows for all premiums to be returned at age 80 when the policy matures, if still the consumer is still living.

Mutual of Omaha Disability Insurance

MOO is one of the best disability companies in America. Disability insurance is often overlooked but is considered one of the most needed insurance coverage’s.

According to the Social Security Administration, 1 in 4 adults will become disabled before the age of 65. Some will be a short-term disability while others will be for life.

A disability, just like an unexpected death, can disrupt or even ruin your life plans as well as take a huge toll on your finances. It’s important to have some type of coverage, because there is one thing you can count on, disabled or not, the bills continue to come in.

Mutual of Omaha Life Insurance offers many types of disability products including:

- Simplified Issue Disability (No Exam Required)

- Accident Only Disability

- Short Term Disability

- Long Term Disability

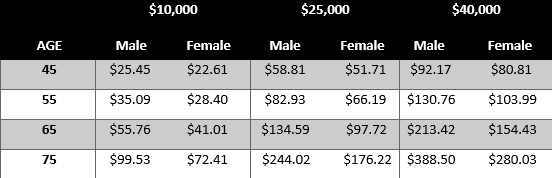

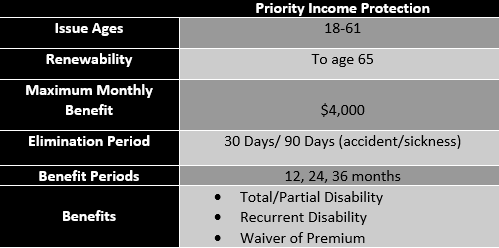

Priority Income Protection (Simplified Issue) Specs:

Disability Income Choice Portfolio Specs:

![]()

![]()

Mutual of Omaha Long Term Care Insurance

A vital part of your asset protection plan is Long Term Care Insurance (LTC). If you have a chronic debilitating condition that keeps you from performing 2 of 6 activities of daily living (ADLs), long-term care insurance can provide money to help pay for any care you may need such as nursing home, home health, or assisted living.

Mutual of Omaha offer 2 long-term care policies. They are:

![]()

![]()

Mutual of Omaha Life Insurance Niches

Mutual of Omaha’s underwriting department have some interesting niches that sets them apart from other carriers.

They are most known for there Fit Underwriting Credit Program. This benefits clients that would normally be rated below standard. MOO offers 14 lifestyle and health credits, that if a client has characteristics of 3 or more of these credits, they could qualify for a better rate class and ultimately a lower premium.

Our Thoughts

While Mutual of Omaha is a great company, they are only 1 of many. It’s important to always acquire multiple quotes to ensure you are choosing the best company that fits your financial needs. If you have any questions or need help obtaining those quotes, please don’t hesitate to give us a call or comment below.

Is Mutual of Omaha a good life insurance company?

Mutual of Omaha is considered an extremely strong financial company. They have earned the top ratings from all the insurance rating agencies. Strong financial ratings ensure that policyholders can know their claims will be paid when the time comes. There rating are:

“A+” Superior Rating with A.M. Best

“AA-” Very Strong Rating with S&P

“A1” Good Rating with Moody’s

Does Mutual of Omaha require an exam for there life insurance?

Mutual of Omaha offers a no exam term life and no exam universal life product with face amounts up to $300K.

What types of products does Mutual of Omaha offer?

Mutual of Omaha offers term life, universal life, simplified issue whole life, children’s whole life, accidental death insurance, long term care insurance and medicare supplements to consumers across America.